BTC Price Prediction: Analyzing the Path to $200K and Beyond

#BTC

- Technical indicators show BTC trading above key moving averages with bullish momentum

- Strong institutional demand is overcoming regulatory concerns in the short-term

- Long-term price predictions remain extremely bullish assuming continued adoption

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building

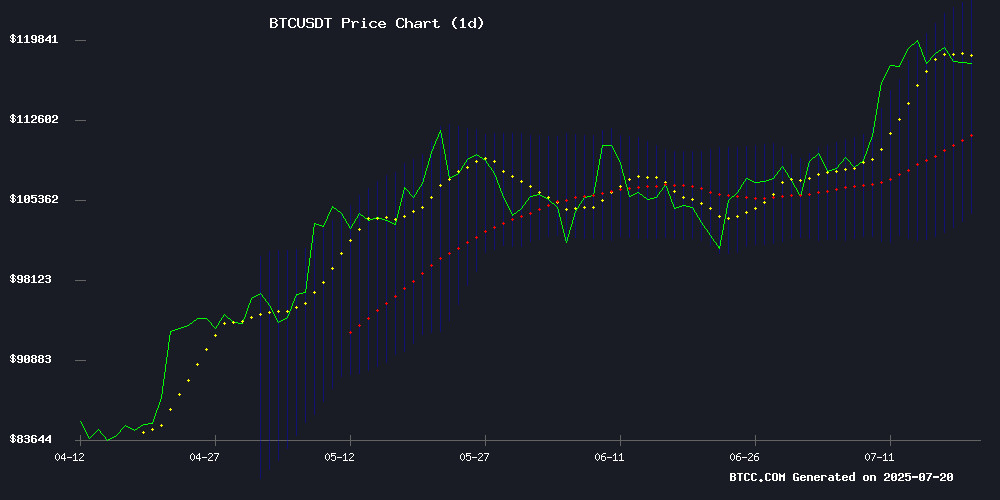

According to BTCC financial analyst Olivia, Bitcoin's current price of $118,378.56 shows strong bullish momentum as it trades above both the 20-day moving average ($113,875.83) and the middle Bollinger Band ($113,875.83). The MACD indicator, while still negative at -1,009.15, shows decreasing bearish momentum as the histogram narrows. With price approaching the upper Bollinger Band at $123,612.13, Olivia suggests this indicates potential for continued upside if the current momentum persists.

Market Sentiment: Institutional Demand Offsets Regulatory Concerns

BTCC's Olivia notes the bullish market sentiment despite regulatory headwinds, as evidenced by Bitcoin's new all-time high and strong institutional demand. Key positive drivers include Coinbase's stock performance, institutional whale movements, and liquidity injections from central banks. However, Olivia cautions that regulatory developments in the UK and stablecoin scrutiny could create short-term volatility. The overall sentiment remains positive with strong fundamentals supporting the rally.

Factors Influencing BTC's Price

Bitcoin Price Surges Past $118K Despite Regulatory Headwinds as Institutional Demand Remains Strong

Bitcoin's price resilience above $118,000 underscores a market torn between regulatory uncertainty and institutional conviction. The GENIUS Act's prohibition on yield-bearing stablecoins briefly rattled investors, yet BTC's bullish momentum remains intact, with technical indicators pointing to further upside.

Institutional adoption continues to dominate the narrative. Bitcoin Standard Treasury Company's planned public listing via a Cantor Fitzgerald-backed SPAC merger—bolstered by its 30,000 BTC holdings—signals deepening institutional commitment. Grayscale's confidential SEC filing for a potential public listing further validates the asset class.

The July 14 rally to $120,000, fueled by pro-crypto legislative progress, demonstrates Bitcoin's capacity to absorb regulatory shocks. Market participants now weigh short-term policy risks against long-term structural demand.

Bitcoin Hits New All-Time High: Analysts Weigh In on What’s Next

Bitcoin surged to a record $117,894 this week, dominating 43% of all crypto-related social media discussions. Santiment analyst Brian Quinlivan flagged the frenzy as a potential retail FOMO signal—historically a precursor to short-term pullbacks.

Despite warning signs, technical indicators remain bullish. BTC holds firmly above key moving averages, with traders eyeing $115,700 as critical support. A breach could trigger retests of $110,000.

Market structure suggests two possible paths: consolidation near current levels for another breakout, or a healthy correction to shake out weak hands. 'Social dominance spikes often mark local tops,' Quinlivan noted, recalling similar patterns during previous cycles.

IMF Report Contradicts El Salvador's Bitcoin Purchase Claims

El Salvador's bold embrace of Bitcoin as legal tender in 2021 positioned the nation at the forefront of cryptocurrency adoption. President Nayib Bukele's administration had consistently publicized daily Bitcoin acquisitions, framing them as a defiance of traditional financial systems. The narrative has now collided with reality.

An IMF compliance report dated July 15 reveals no Bitcoin purchases by El Salvador since February 2025. This directly contradicts official statements from Bukele's Bitcoin Office, which had maintained a steady drumbeat of acquisition announcements since November 2022. The discrepancy raises questions about the transparency of the country's cryptocurrency operations.

Market observers note the IMF findings transform El Salvador's much-touted Bitcoin strategy from an active accumulation play to what appears to be passive holding. The report clarifies that observed blockchain movements represent portfolio consolidation rather than new purchases - a technical distinction with significant political implications.

Crypto Crime Surges in 2025, Threatening Mainstream Adoption

Crypto-related theft is escalating at an alarming rate, with over $2.17 billion stolen as of July 2025—surpassing the entirety of 2024's record-breaking figures. Wallet drainer attacks have risen 67% year-over-year, exposing systemic vulnerabilities in the sector.

Chainalysis data reveals a grim trajectory, positioning 2025 as the worst year for crypto crime yet. The industry's credibility is eroding in real time, according to Komodo CTO Kadan Stadelmann, who describes crypto as a playground for exploiters rather than a foundation for mainstream finance.

Historical parallels abound, from Mt. Gox's epic collapse to OneCoin's elaborate fraud. As digital assets gain value, malicious actors refine their tactics—a relentless cat-and-mouse game that shows no signs of abating.

Coinbase Stock Hits Historic High Amid Crypto Market Rally

Coinbase shares surged to a record $437 this week, marking a 6.9% weekly gain and a 69% year-to-date increase. The rally reflects heightened institutional interest in crypto, evidenced by strong ETF inflows and Bitcoin's recent all-time highs.

The exchange's stock performance mirrors broader industry momentum, with investors seeking exposure to digital assets through traditional equity channels. CEO Brian Armstrong attended the White House signing of the GENIUS Act, calling it a watershed moment for crypto legitimacy.

Professor Coin: Can Bitcoin Replace Gold?

Bitcoin's comparison to gold as a 'digital store of value' faces scrutiny amid academic research highlighting fundamental differences. While gold's historical resilience and crisis-tested stability remain unmatched, Bitcoin's decentralized nature offers a modern alternative.

Professor Andrew Urquhart's analysis underscores Bitcoin's lack of a long-term track record compared to gold's centuries-long role as collateral and currency. The debate hinges on whether cryptographic scarcity can rival physical scarcity in the eyes of investors.

UK Government Considers £5 Billion Bitcoin Sale to Address Fiscal Deficit

The UK Treasury is weighing a massive sale of seized Bitcoin holdings worth over £5 billion ($6.7 billion) to help plug a £20 billion budget shortfall. Chancellor Rachel Reeves sees the crypto windfall as a potential alternative to tax hikes or spending cuts amid economic stagnation.

British authorities confiscated at least 61,000 BTC in 2018 during an investigation into a Chinese Ponzi scheme. The stash—initially valued at £300 million—has ballooned in value alongside Bitcoin's price appreciation. The digital assets were linked to money laundering activities, including those of convicted individual Jian Wen.

With inflation persisting and borrowing costs rising, the government faces mounting pressure to stabilize public finances. The proposed Bitcoin liquidation could provide immediate fiscal relief but risks missing out on further appreciation of the cryptocurrency holdings.

Bitcoin Whale Moves $9.6B Amid Stablecoin Regulatory Scrutiny

A historic Bitcoin whale transaction of $9.6 billion has sent shockwaves through crypto markets, coinciding with heightened regulatory focus on stablecoins under the GENIUS Act. The movement—one of the largest on-chain transfers in BTC history—has sparked speculation about strategic repositioning ahead of impending audit requirements for USD-pegged assets.

Market analysts interpret the whale activity as a potential risk-off signal, with WhaleWire CEO Jacob King suggesting the seller may be anticipating tighter stablecoin oversight. The U.S. Senate's recent passage of three crypto regulation bills adds further pressure, particularly for Tether and other issuers facing new transparency mandates.

Seasoned investors are reevaluating portfolios as these developments converge. While BTC dominance faces headwinds, opportunities may emerge in altcoins with strong fundamentals and regulatory clarity—though risk management remains paramount in this shifting landscape.

Geopolitical Tensions Threaten European Bitcoin Mining Infrastructure

Europe's escalating geopolitical instability poses a direct risk to Bitcoin mining operations across the region. With Germany accounting for 5% of Bitcoin's global hashrate, Norway 2%, and Russia 11%, a large-scale conflict could disrupt critical mining infrastructure. These facilities, often integrated with local energy grids through hydropower and renewable sources, face potential collateral damage or energy rationing in wartime scenarios.

The interdependence between miners and local communities has become starkly visible in Norway. When one mining operation ceased activities, residential power bills surged by $300 annually—the miner had previously subsidized 20% of regional grid fees. Such cases demonstrate how crypto mining has evolved into quasi-critical infrastructure for some European communities.

Robinhood’s Valuation Soars to $100B Amid US Crypto Regulatory Shift

Robinhood shares surged to a record high of $113.38, capping a 30-month rally of 38% and pushing its market capitalization to $100 billion. Despite a slight pullback to $109, the stock retains a 4.07% residual gain, signaling sustained bullish momentum.

The rally coincides with Bitcoin’s retreat to $118,300 after a brief rally to $123K, underscoring divergent market forces. The catalyst? Landmark US crypto legislation. Three pivotal bills—including Trump’s GENIUS Act—now provide a regulatory framework for institutional crypto operations, mandating stablecoin issuers to back reserves with Treasuries and USD.

The Clarity Act further delineates market structure, passed with overwhelming House support. These developments mark a decisive pivot toward tokenization, with implications for BTC, ETH, and other major assets.

Bitcoin Breakout Fueled by Bank of Japan's Unusual Liquidity Move, Says Arthur Hayes

Former BitMEX CEO Arthur Hayes identifies the Bank of Japan's recent dollar liquidity provision as a bullish catalyst for Bitcoin. The BOJ's July 17 announcement to supply USD funds against pooled collateral marks a strategic shift aimed at easing global dollar market stress—a scenario Hayes predicted in his 2022 essay 'Shikata Ga Nai'.

Central bank liquidity injections typically benefit risk assets, and Hayes contends this move could accelerate Bitcoin's next upward leg. The analysis will feature prominently in his August 25 keynote at Tokyo's WebX conference, where he'll connect monetary policy shifts to crypto market dynamics.

Market data shows increased BTC inflows following the BOJ's policy change, suggesting traders are positioning for potential fiat debasement effects. Hayes' thesis hinges on a domino effect: as dollar liquidity tightens globally, central banks will flood markets with currency—creating ideal conditions for hard assets like Bitcoin to appreciate.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market fundamentals, BTCC's Olivia provides these long-term projections:

| Year | Conservative | Base Case | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $95,000 | $135,000 | $175,000 | ETF flows, halving effects |

| 2030 | $250,000 | $400,000 | $600,000 | Institutional adoption |

| 2035 | $800,000 | $1.2M | $2M | Store-of-value narrative |

| 2040 | $1.5M | $3M | $5M+ | Global reserve asset status |

Note: These forecasts assume continued network adoption without existential regulatory actions. Price targets could vary significantly based on macroeconomic conditions and technological developments.